Tax Free Gift Limit 2025 Australia Ato. There is no limit on how much money you can give or receive as a gift in australia. Count the excess in your assets test;

Find out the caps and limits on super contributions and how they are taxed. You can only claim a tax deduction for gifts or donations to organisations which are deductible gift recipients (dgrs).

Ato Tax Rates 202424 Vyky Regine, When you make a gift, you do not receive a material. If your gift fits the above criteria, you and the gift giver don’t pay tax on it.

TaxFree Gifts What Is It And How Much Can You Give? Crixeo, About tax rates for australian residents. There’s no limit on how much money you can give or receive as a gift!

What Is The Limit On Gift Tax For 2025 Rory Walliw, If you gift more than the allowable amount the amount over the above. Find out about caps on contributions to defined benefit funds and constitutionally protected (cpf) funds.

Gift Limit Tax 2025 Evonne Thekla, About tax rates for australian residents. There is no limit on how much money you can give or receive as a gift in australia.

Max Tax Free Gift 2025 Aggy Lonnie, The amount you can claim as a deduction for a gift or donation to a dgr depends on the type of gift. Their gift may meet the.

Ato Tax Declaration Form Printable Printable Forms Free Online, However, it would not be surprising if the current federal government. This is called the $30,000 rule.

Irs Tax Free Gift Limit 2025 Janene Gaylene, You can only claim a tax deduction for gifts or donations to organisations which are deductible gift recipients (dgrs). You should keep records for all tax deductible gifts, donations and contributions you make.

annual gift tax exclusion 2025 irs Trina Stack, Find out the caps and limits on super contributions and how they are taxed. Yes, an employer can give a gift to an employee.

401 K Contribution Limits 2025 Cheri Honoria, I'm aware through reading the site that gift cards for employees are exempt from fbt and can be claimed as a tax deduction if under $300. Find out about caps on contributions to defined benefit funds and constitutionally protected (cpf) funds.

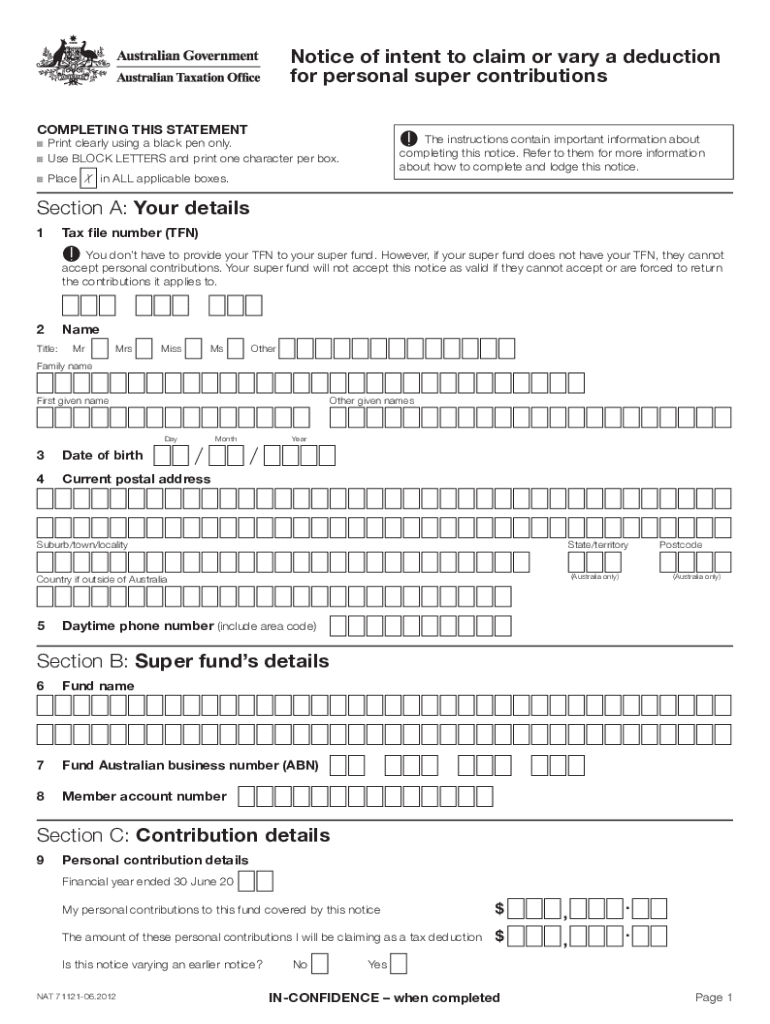

Deduction For Personal Super Contributions Australian Taxation Office, But there are tax implications depending on whether the gift is: Hi @dmac, there isn't a limit on how much money you can send as a gift, and no time frame for the recipient to use the money.